Mohammad Anwar Hossain: Islamic financial system is the best financial system for all which is conducted in the light of the Holy Quran and Sunnah. Islam is a complete code of life. Islam has clear guidelines in all areas of human life. The Islamic financial system is based on justice, fairness, proper distribution and the production of wealth. This system is based on Islamic culture and Tamaddun. Human welfare is the main goal of the Islamic financial system. Islamic financial system is the overall welfare management of all worldly resources to nurture the creation by following the principles of Almighty Allah, which shows the way of liberation in this world and in the hereafter by ensuring human welfare. Islamic financial system has immense opportunities for socio-economic and political freedom which helps people to become good citizens.

Islamic financial system includes standard welfare, scientific and balanced Islamic financial method. It is more progressive than any capitalist or socialist financial system which indicates the blessings for humanity. Islamic financial system is deeply rooted in Islamic ideology, philosophy of life, civilization and culture. Only the Islamic financial system can provide a fair and lasting solution to all kinds of economic problems of all people. If it can be implemented, peace and security of the society will prevail and unrest, misery, deprivation and inequality between rich and poor will be eliminated from the society.

A review of Kholafaye Rashedeen and subsequent economic affairs shows that for the economic emancipation of the human race, Islam provides an acceptable policy regarding the highest production and consumption and a fair and equitable distribution system in accordance with Shariah and ensuring the welfare of humanity. As a result, the balance of economic activities including exchange of assets, circulation of currency, advanced and scientific methods of buying and selling, the introduction of the auction, existing tax policy, market management, rationing, international exchange, drug prohibition, taxation, state expenditure and balanced policies for economic activities have been formulated. In this way, it was possible to establish peace and prosperity in society.

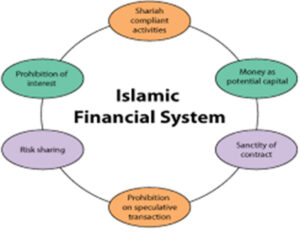

Characteristics and Principles of Islamic Financial System:

- Almighty Allah is the original owner and supplier of wealth. He is the Creator, Owner and Sustainer of this earth and the universe.

- The real owner of wealth is not a man. People are just depositors and users or consumers. Therefore, people will produce, earn and consume wealth according to the will of Allah, the original owner of wealth.

- Man’s socio-economic issues are integrated and inseparable from his/her beliefs, ideals and values. Therefore, his belief, ideology and Sharia, i.e Qur’an, Sunnah, Ijma, Qiyas will be the basis for the development and positive guidance of his socio-economic issues. At the same time logic, wisdom and experience must be followed.

- One of the basic principles of the Islamic economic system is the welfare of all people.

- Islamic financial system does not consist of conflict, but it includes mutual sympathy, cooperation and benevolence.

- All forms of oppression and injustice are prohibited in this financial system.

- Islamic finance system emphasizes on production, earning and development.

- In the Islamic financial system, miserliness of wealth, lazy accumulation and unproductive hoarding are prohibited.

- It has become a tool to liberate people and humanity from destruction and misery.

- Misuse, misappropriation and waste of resources are prohibited in the Islamic financial system.

- Islamic financial system dictates the use of moderation in spending.

- It recognizes the right of property of the individual.

- It provides guidance to meet the basic needs of the people.

- This system emphasizes fairness and balance in the economy of the society.

- It provides individual ownership. Every man and woman is the rightful owner of their own property acquired through legal means. Men and women have the right to freely invest, develop and use their assets acquired through legal means.

- This system is normative but not positive. It is not like Capitalism or Socialism where everything is positive ignoring the norms.

- This system is universal as well as humanitarian.

Wealth plays an important role in the Islamic financial system: Allah the Almighty is the absolute owner of wealth. Men are the only trustee of personal wealth. Man is the Khalifa or representative of Allah. So wealth will be acquired and spent according to the command of Allah and recognizes the legal ownership of the property, whereas in the socialist economy the individual cannot own wealth. The state owns all the assets. The person will get an allowance from the state according to his need.

On the other hand in capitalism, the absolute ownership of the individual is recognized. In capitalism, individuals can earn and spend wealth in any way. For this reason, one group of people is rich and the other group is poor. Capitalism cannot alleviate poverty.

Islamic financial system was introduced in the golden age of Islam. At that time there was none to receive Zakat in the society. This system is based on morality and ethics.

It is forbidden to manipulate the wealth for own interest in the Islamic financial system. In this economy, what is good for people can be done. Islamic economics does not allow people to do what is bad for society. The main goal of this system is the welfare of both the world and the hereafter. The main aim of capitalist economics is to maximize the market share of wealth. Due to this more production is done for the excessive benefit for own sake as a result, the environment is polluted by chemical waste. Need to provisions of Hhalal (legal) and Haram (illegal) in Islamic financial System.

In the pre-Islamic era, there was no difference between Halal and Haram among the people. Even in the present age, there is no distinction between Halal and Haram in general finance. In the Islamic ideology, Halal things are considered permissible and Haram things are considered unlawful. Therefore, in the case of Islamic finance, the prohibited items for investing, manufacturing, marketing, etc. such as alcohol, gaza, opium, etc. are declared banned by Islamic economists and also declared not to do business with these banned items.

Islam is a Allah-given religion that is universal and practical for mankind. It is a balanced way of life that must be followed to solve the problems of humanity in society which establishes peace and justice in a prosperous world. It has been gained perfection through the last prophet and messenger, Hazrat Muhammad (peace be upon him) in the form of Islamic life philosophy. Islam is not just the name of philosophy or practice describing a religious practice or formal activity. On the contrary, it has laid down the basic principles and guidelines for the solution of all kinds of human problems and for the overall conduct of present and future life.

Thus, the Islamic economic system has been established through the solution of economic problems of human life, sustainable and universal principles of economic activities, and practical management. Subsequently, Islamic economics has been developed through research in the light of the Qur’anic and Sunnah. This system is an ongoing and eternal system that is useful and welfare-oriented for people of all times all religions all crest cast simultaneously

Islamic economics help to reduce economic recession by banning interest, hoarding, speculation and gambling. Economic recession will not be able to spread its wings if these factors are followed.

Riba or interest is forbidden in Islamic finance: Interest is a tool of oppression in the economy. That is one of the tools in capitalist and socialist businesses. Interest is strictly forbidden in Islamic finance and business is legal or halal. Allah the Almighty says:

“Allah will destroy usury and will give increase for deeds of charity, alms etc.and Allah likes not the disbelievers, sinners.(Surah Al-Baqara: 276)

In the interest-based economy, the production of the essential is hampered by the higher rate of interest. As a result, employment is not created. Unemployment and social unrest are created for this. The value of money decreases due to interest. Speculation is created in the market. Gambling, lotteries, etc. are forbidden in the Islamic financial system. There is no blessing in Haram goods. Allah the Almighty says:

“Know that the interest you pay in the hope of increasing one’s wealth will never increase in the sight of Allah. The only thing that you give for Zakat for the sake of Allah is that it increases.(Surah Ar-Rum: 39)

The interest-based economy has upset the balance of wealth distribution there and the downturn in industry and trade has brought the economic life of the nation to the brink of collapse. In comparison, a closer look at the early days of the Islamic era reveals that when the Islamic economic system was fully established there, national progress and prosperity reached such a level in just a few years that zakat recipients were sought but nowhere to be found. One could not find a person who did not have the ability and capacity to pay Zakat himself. By comparing these two conditions side by side, it will be possible to understand unequivocally how Allah wipes out usury and gives sadaqah (gift).

Islamic finance is not just interest-free finance: This is something more. For example, it must be taken into consideration such as Gharar(uncertainty), Haram, Zakat, and Karze- Hasana i.e interest-free loan for the betterment of the society.

Islam creates a mentality completely different from the capitalist mentality. The capitalist cannot imagine how one person can give his money to another without interest. He borrows money and not only collects interest on it but also seizes the borrower’s clothes and home furnishings to collect his capital and interest. But the teaching of Islam is that not only should the needy be given a loan, but if his financial difficulties are too great, he should not be begged, even if he does not have the ability to repay the loan, he should be forgiven.

Allah the Almighty says in this regard: “If the borrower is in dire straits, give him a chance until he is financially solvent and if you forgive him, it will be better for you. If you had some knowledge, you would be able to appreciate its benefits. – (Surah al-Baqara: 280)

Interest is the driving force behind the economic downturn. Interest is the main cause of the economic recession, inflation, increase in income inequality, and the creation of socio-economic injustice. That is why Islam has banned usury forever. If it is possible to remove interest from the economy, speculation will be stopped. A lasting balance in the economy will be established through increased investment and production. If interest is banned, the whole financial system will be transformed into an equity-based real estate asset. Converting interest-bearing debt into equity will reduce the economic downturn.

A.Garar (uncertainty) and Speculation: Garar is the complete or additional uncertainty in a business or business contract or financial transaction. Risky or fraudulent buying and selling is called buying by Al Garar. Excessive shortages have led to speculation in the trading, stock, and stock markets.

In business, Islam prohibits speculation, which involves additional ambiguity and uncertainty. One side will benefit more and the other side will be poor. This is not desirable in Islam. For this reason, speculative transactions like Mulamasa, Munabaya, etc. are prohibited in Islam.

- Mysir or gambling: Mysir means hard work or hardship. It is said that a large amount of money is acquired easily and without hard work. By this one side gains unjustly and the other side suffers immensely. It is forbidden in Islam. In this regard, it has been said in the Qur’an, “Alcohol, gambling, the altar of idolatry and the arrow that determines one’s destiny are the work of the abominable devil in order that you may be successful.”

(Surah Al- Maeda, Verse-90)

If there is no gambling practice in business, there will be no chance of economic crisis.

- Jahlah:

Jahlah or ignorance is also a kind of garar. Jahalah is a type of transaction where the buyer does not know what he is buying or the seller does not know what he is selling. A common feature of this is that it does not specify the product sold, the price of the product, the time of sale and where the product will be delivered to the buyer. If the content of the agreement is not clear in the case of concluding a commercial agreement in Islam, the agreement will not be pure. For example, it is not legal to sell underwater fish. The Prophet (peace and blessings of Allaah be upon him) said, ‘Do not sell underwater fish. Because it is uncertain or Garar.

- Bai Ad-Dain:

Selling a loan in exchange for a loan is called Bai Ad-Dain. The sale of loans on the basis of discounting is forbidden in Islam. All members of the Islamic Fiqh Academy have unanimously accepted the prohibition on the sale of loans without any disagreement. In this context, it has been said in the hadith, “Rasul (SAW) forbade the sale of loans in exchange for loans.”

According to Ibn Taymiyyah, if marriage is ‘Gharar’ and creates greed for the property of others, it is like gambling and is haraam as usual. Business parties make transactions to ensure their maximum profit, not to take possession of other people’s property.

The basic idea is that the investor will try his best to find a ‘safe’ project for investment, which is strongly supported by Islamic Shariah and he will share in the success and failure of that project.

Investment policy in the Islamic financial system: Investment in production and consumer goods is conducted in the light of strict Islamic principles. Muslims are not allowed to invest in any organization that produces, distributes, and consumes drugs, tobacco, pornography, gambling, illicit drugs, and other harmful products, even if it is a very lucrative organization. Moreover, Islam does not allow investment in anything that is harmful to the individual and society. Thus, the investment facilities of Islamic financial systems are limited in some respects as compared to the conventional interest-bearing financial systems.

Mode of Islamic finance: There are currently seven Islamic methods as opposed to interest-based finance: As Mudaraba means faith-based financing, Musharaka means equity financing, Ijarah means lease finance or contract-based financing, Murabaha means a sale on profit, l Bai- Al Muajjal means credit-based financing and Istisna means advanced payment financing. Among these, Mudaraba and Musharaka possess distinctive features that have established Islamic banking and finance as an alternative to interest-based finance.

Mudaraba and Musharakar the most popular and important Islamic investment method in Islamic finance has given preference to the Murabaha method over Mudaraba and Musharakar.

Islamic banking and finance are trying to strengthen their position as an alternative to conventional interest-based finance and banking. According to the General Assembly of the Islamic Banks and Financial Institute, there are currently 275 Islamic banking and financial policy institutions in the world with a turnover of over two hundred billion US dollars. Its activities are spread in 53 countries of the world including Europe and America. In the United States itself, 22 organizations have provided economic services to the people in an Islamic manner.

In most countries, Islamic banking institutions have to survive by competing with conventional interest-based banking institutions. Successful management and the growing number of Muslims in Europe and North America are among the reasons why the West has turned its attention to Islamic banking and finance. Western financial institutions are therefore now offering Islamic investment methods to Muslim investors.

Zakat in Islamic Financial system: The essence of Islam’s approach to economics is that wealth cannot be accumulated on one hand; Islam wants the people of the Islamic society who have amassed extra wealth due to their superior merits and good fortune not to accumulate this wealth but to spend it.

In this way, people will find it bad to accumulate wealth according to their natural desires and will be eager to spend it. On the other hand, Islam enacts laws for not to accumulate and spent it to their own bad mindset or who have accumulated wealth in some way it will be deducted. This is called Zakat. This Zakat has been given so much importance in the economic affairs of Islam that it has even been included as one of the main pillars of Islam. This Zakat has been emphasized the most after the Salat(Prayer) and it has been declared in an unequivocal voice that the person who saves money and property beyond his/her necessity cannot be Halal(legal) until he pays Zakat.

“(O Prophet!) Take alms out of their wealth, which will make it pure and lawful.” (Surah at-Tawbah: 103)

It is cleared from the last word of the verse that the wealth accumulated by a rich person is unclean in the eyes of Islam and cannot be pured unless its owner spends at least a certain amount (2.50% approx.) every year in the fixed sectors as declared in verse-60 of Surah at-Tawbah of the Holy Quran.

Here again, there is a stark contrast between the principles and methods of capitalism and Islam. Capitalism demands that money be saved and interest be paid to increase it. As a result, all the money of the people around will fall into this pond. On the contrary, Islam instructs that money should not be deposited or attacked first and if it ever accumulates then the drain should be cut from this pond so that water reaches the dried-up fields and all the surrounding lands become fresh and green. In the Islamic system, it is free, independent and dynamic.

Islamic financial system and inherited law: Islam introduced another step named Inherited law for not to decentralize the money that will be concentrated in one place even after spending money on one’s personal and social needs and also in the way of Allah. The purpose of this law is that the person who dies leaving his wealth, no matter how low or high, will be cut into pieces and distributed among all the near and far relatives. If there is a person who has no heir, he should deposit his wealth in the Baitulmal(Govt. treasury) of the Muslims so that the whole nation can benefit from this.

The Aausterity in Islamic Financial System: On the one hand, Islam has made arrangements for the circulation of wealth among the people of the country and for the benefit of the poor from the wealth of the rich, on the other hand, it has instructed every person to be frugal in the use of money and resources. In this way the individual will never upset the economic balance by resorting to polarity in the use of economic means. In this case, the basic teachings of the Qur’an are:

“And don’t tie your hands around your neck and don’t open it at all, which makes you feel like you’re going to regret it later.” (Surah Bani Isra’il: 29)

“And when the pious servants of Allah spend, they do not spend extravagantly, nor do they become stingy, but they keep a balance between the two. (Surah al-Furqan: 67)

The purpose of this education is to ensure that every person spends money within his means. His spending should never reach such a level that it exceeds his income and he has to reach out to others for his own frivolous expenses or he has to share in the earnings of others and borrow from others without proper need. Then he will forcefully return the glass to the lender or use all his financial instruments to collect the loan and eventually go bankrupt and write his name in the register of Fakirs (very poor) and Miskans(normal poor). Again, he should not be stingy enough to spend far less than he can afford. Spending within the limits of one’s income and financial means does not mean that if he earns a good income he will spend all his money only on personal comforts and luxuries and on the other hand his relatives, friends and neighbors will spend the day in extreme crisis. Islam has considered such selfish spending excess as extravagance.

“Give to the near of kin his rights, and give to the poor and the wayfarer their rights. Don’t waste money. Those who spend in vain are the brothers of Satan. And Satan is ever ungrateful to his Lord. ”(Surah al –Isra: 26-27)

In this case, Islam has not only given moral education but has also enacted laws to prevent the ultimate state of stinginess and extravagance. Attempts have been made to block all avenues that upset the distribution of wealth. Gambling has been declared Haraam. Alcohol and immorality have been prevented. Expensive practices of vain playfulness and jokes whose inevitable consequence is nothing but a waste of money and time.

Islam instructs people to live a simple and plain life through moral education. In this unpretentious life, the limits of human needs and aspirations can never be so wide that it will be impossible for him to run a middle-income family and he will have to go beyond his normal limits and share in the income of others. If he enjoys all the money he has earned and will not help his other brothers who are earning less than the average it will be an example of selfishness.

The concept of development in Islamic economics: The main task of Islam is to change the nature of one’s values and to restructure one’s social environment in order to guide human development in the right direction.

It reviews all aspects of human economic life within the framework of overall human development. For this reason, the main issue in Islam, even in the economic sector, is its moral and integrated human development. Because economic development is an essential part of the moral and socio-economic development of individuals and human society. Allah the Almighty has said in this regard:

“Allah does not change the condition of a people until they change their own attributes (Surah Ar-Ra’d; verse 11).

The priority of Islamic development strategy is also understood from the following hadith of the Prophet (Peace be upon him):

* When a Muslim plants a tree or cultivates it and then eats birds, people and animals from it, it is considered as Sadaqah. (Sahe Al-Bukhari).

* No one has ever eaten better food than earning it with his own hands (Sunan Ibn Majah, Bukhari)

* The upper hand is better than the lower hand (Sahe Al-Bukhari).

Some of the basic principles and values mentioned above, especially in the context of individual and macroeconomic development efforts, provide some elements of development ideas. The essential parts of these elements are described below:

Thus, economic development in the Islamic framework is a destination-oriented and value-oriented activity through the active participation of the people and the management of the highest human welfare in all respects. It is inevitable to make the whole people strong so that they can perform all the functions of the representative of Allah in the world and bring mankind as a moderate nation towards a just society, what Islam desires for mankind. Development means the highest socio-economic welfare of the society through the moral, spiritual and worldly development of the individual and the establishment of peace and justice in the society because we know injustice anywhere is a threat to justice everywhere.

Islamic economic system in the pandemic situation: In the past, many epidemics since the creation of the world have devastated the entire economy of the world. The COVID-19 epidemic is threatening the whole world today. We are facing a dilapidated state of treatment, unemployment and scarcity of food due to pandemics. The United Nations says a lockdown on the coronavirus could lead to a global food crisis. According to a survey, about 600 million people worldwide are already suffering from food insecurity. The United Nations believes the crisis could escalate in the coming days. So in this situation, the people of the circle have to stand by the helpless people. Islam is the religion of humanity. We have to serve the hungry, the sick, and the deprived people. The rights of relatives and neighbors have to be realized. In this regard, Allah the Almighty said,

“In their wealth is the right of the deprived and the helper.”

(Surah Al -Zariyat – :19)

Islamic financial system can play a vital role in the economic development of the people as well as the country. It emphasizes humanity in solving any problem which is unimaginable in other religions. Islamic economic system has specific principles for all economic problems. It has got the attention of the individuals and business class in the global financial sector. The system has successfully performed its role for the welfare of the people. Among the basic features of Islamic finance are that the humanitarian expenditure sectors like Zakat, Sadaqah, Ushr, Karje Hasanah can play a special role in helping the people affected by the Corona diseases. Through which economic activities will be prosperous and dynamic. We see this dynamism only in the Islamic economic system instead of capitalism and socialism. This system is considered to be a great achievement not only in Muslims but the non-Muslim of the world. Due to distinct financial features from the traditional system, the Islamic financial system is best for all like researchers, scholars, academicians, and other related people.

References:

- Thought on Economics (Journal)

-January-June 2003|

- Arthonity Gabashona Shangkha-2020 (Economics research -2020)

- Islamic Ain O Bichar(Islamic law and justice)

- Islamic Foundation Patrika( Islamic Foundation Magazine)

- Poverty alleviation in Islam

-Dr. Yusuf Al-Kardavi

- Islamic Banking Journal

- Islam is the solution to life’s problems

– Dewan Mohammad Azraf

- The economic system of Islam

-Sheikh Mahmud Ahmed

- Islamic Economics

-Dr. Muhammad Nurul Islam.

- The economic system of Islam

– Maulana Hifzur Rahman

-Translation: Maulana Abdul Awal

- Islamic Ortho Babosta(Islamic Economic System)

-Mohammad Shamsul Haque

- Islamic Finance (Journal) September 2019

- The Islamic concept of development

-Bangladesh Institude of Islamic Thought (BIIT)

- Finance and Economics

-Abdus Samad (PhD) Assistant Professor, Utai State College, Orem